Contact us

Contact us

As an international group of microfinance institutions (MFIs) in Africa, Advans aims to provide tailored financial services to small businesses, and other economic agents who have inadequate, limited, or non-existent access to traditional financial services, to help them achieve their professional or personal objectives.

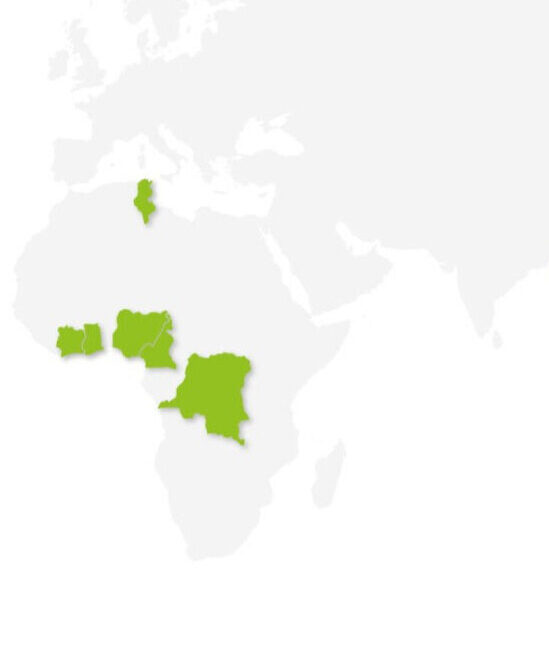

Advans targets developing markets where customers have limited access to financial services and where there is high potential for growth and social value creation.

Its international microfinance institutions (MFIS) are currently established in seven countries: Cameroon, Ghana, Democratic Republic of Congo, Côte d’Ivoire, Nigeria, Tunisia.

Managing Director: Mamie Kalonda Clients: 75,250 Branches: 14 Creation: 2007 More information on: Advans Cameroon

Managing Director: Mariam Djibo Clients: 248,400 Branches: 25 Creation: 2012 More information on: Advans Côte d’Ivoire

Managing Director: Guillaume Valence Clients: 136,700 Branches: 19 Creation: 2008 More information on: Advans Ghana

Managing Director: Gaetan Debuchy Clients: 96,500 Branches: 30 Creation: 2013 More information on: Advans Nigeria

Managing Director: Jean-Luc Nzoubou Clients: 94,200 Agencies: 11 Creation: 2009 More information on: Advans Congo

Managing Director: Meriem Zine Clients: 33,050 Agencies: 24 Creation: 2015 More information on : Advans Tunisie

Choose your preferred way to contact us!

Microfinance involves providing financial services, such as loans, savings solutions, and insurance, to entrepreneurs and underserved populations who lack access to traditional banking services. Our microfinance organization is committed to delivering these services to support the economic and social development of communities in Africa.

Because they employ the vast majority of the workforce, small businesses play a vital role in economic and social development in emerging markets. To develop and strengthen their activities, these small businesses need financial support which they lack, often inaccessible to traditional financial players. Advans’ goal is to democratize access to financial services for these small businesses, and thus contribute to inclusive growth in the countries where we operate.